Financial Advisors Are Working Two Jobs Gen Z Advisors Should Be Prepared

Most programs do a great job at teaching the technical skills. Few teach how to grow

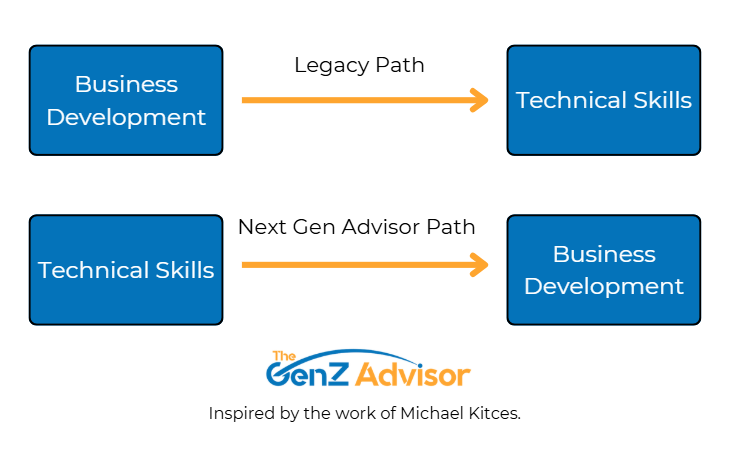

In the old days, advisors grew up in the industry cold calling and building a book from scratch. The ones who made it through learned how to develop business first and picked up the technical skills later.

That’s no longer the case, and Gen Z advisors need to understand the shift.

Two Jobs? What Do You Mean?

As a producing advisor, you’re expected to bring in clients and build a book of business. That hasn’t changed. If you can’t develop business, you’ll likely struggle unless you remain strictly in a service advisor role.

You’re also expected to retain and serve clients many of whom will expect high level planning, timely follow-up, and deep trust. Both are full time jobs.

And most young professionals don’t realize this isn’t a 9-to-5 career.

Now, every firm is different. Some teams split business development and planning roles. But most of the top advisors the ones who move fast get good at both. The best advisors aren’t just great planners. They’re also great business builders.

There’s a Gap

The problem is, most early career programs focus heavily on technical training and neglect the business development side entirely.

So what happens? Advisors come out technically proficient but developmentally underprepared. When it’s finally time to grow a book they don’t know how.

This is the reverse of how it used to be. Instead of developing sales skills early and layering on planning skills over time, the new model flips that and Gen Z advisors are the ones navigating this new path.

The 4 Domains of Advisor Mastery

Michael Kitces wrote a great piece on the four skill domains every advisor needs to master:

Technical Competency (planning, products, investments)

Empathy (client relationships, trust)

Management (business execution, systems)

Sales (business development)

The best advisors do more across all four areas.

What Gen Z Advisors Can Do Differently

The good news? Gen Z advisors are coming in more prepared than ever when it comes to technical training. That raises the quality of advice across the board.

But you can’t stop there. If you want to be an advisor who builds something real a book, a brand, a firm you need to start developing the other half of the job early on.

Here’s how:

Start Building Your Personal Brand

Use LinkedIn to document your journey, share lessons, and connect with peers and mentors. Visibility builds trust and eventually, opportunity.

Practice Storytelling

Be able to clearly explain why you’re an advisor, who you serve, and how you help. Storytelling is how clients will remember you.

Explore a Niche

You don’t need to lock one in today, but start thinking like a specialist. Who are you uniquely positioned to serve? Start understanding their world now.

Get Reps with Real People

Talk to mentors. Practice explaining what you do. Offer to help peers or family. The more conversations you have, the easier it gets.

Create a Relationship System

You’ll meet a ton of people. Keep a simple system spreadsheet, notes app to track who you meet, when to follow up, and how to add value.

Final Word

Being a great planner is the baseline. If your long-term goal is to become a true advisor the kind that builds and leads you’re going to need both technical skill and the ability to grow a business. Start developing that now. You’ll thank yourself later.

Resources

Share Your Story: Advisor Journeys